PUBLIC SAFETY ALERTS

NEWS & ANNOUNCEMENTS

By Greg Thomas

/ September 27, 2023

FOR IMMEDIATE RELEASE SEPTEMBER 25, 2022 Contact: Melissa Hodges Public Affairs Director/Spokesperson Melissa.Hodges@usdoj.gov MDGA.gov | @USAO_MDGA ALBANY, Ga. – A...

Read More

By Greg Thomas

/ September 25, 2023

The Houston County Sheriff's Office Criminal Investigations Division is trying to identify the subject pictured in this photograph. This photograph...

Read More

By Greg Thomas

/ September 7, 2023

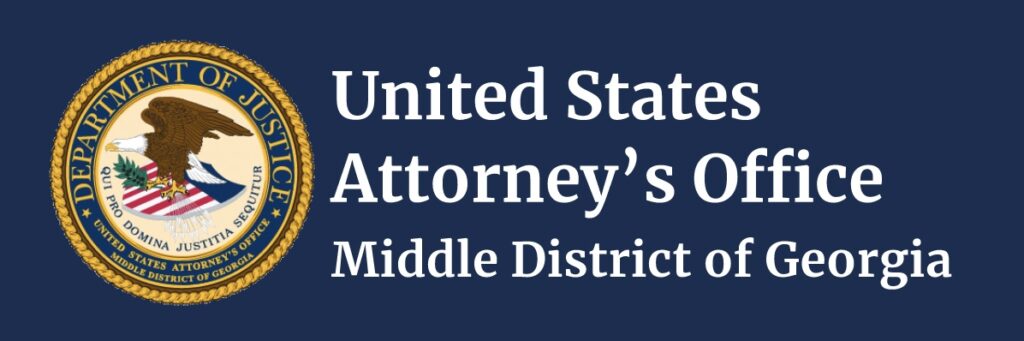

The Bibb County Sheriff's Office Gang Unit is asking for assistance with identifying the two persons of interest shown above.

Read More

By Greg Thomas

/ September 7, 2023

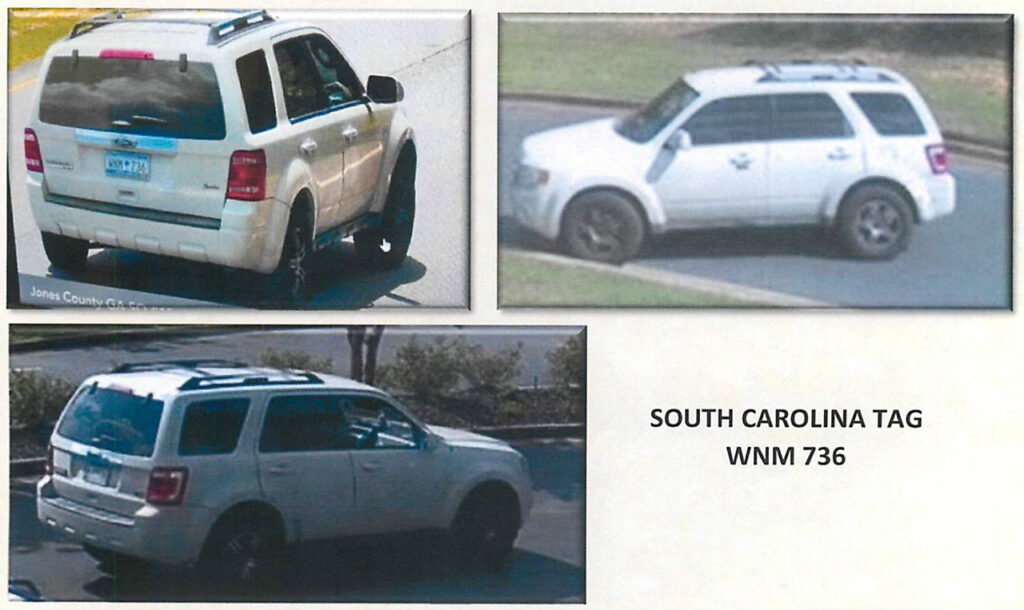

Individuals occupying the 2011 Ford Escape shown above stole mail from a mailbox at the Real-Life Church, 2491 Gray Hwy.

Read More

By Greg Thomas

/ September 7, 2023

The individual shown below stole merchandise including Adidas and Nike products from Kohl's on Zebulon Rd.

Read More

By Greg Thomas

/ August 4, 2023

Bibb County Sheriff's Office investigators are working multiple cases of forgery that are related to the theft of mail that...

Read More

By Greg Thomas

/ June 29, 2023

Clifton Tucker Jr. pictured above is currently wanted for 2 counts of Felony, Deposit Account Fraud that occurred in Monroe...

Read More

By Greg Thomas

/ June 14, 2023

Theft case that occurred at a Donation Bin located in the parking lot at Mt. Zion Baptist Church on Rivoli...

Read More

By Greg Thomas

/ June 7, 2023

Remain anonymous and help us locate the #WANTED fugitives seen in this week’s video. Submit a tip online today at...

Read More

By Greg Thomas

/ June 5, 2023

The Forsyth Police Department is looking for information from the public regarding the shooting that occurred on 6-4-23 at the...

Read More

Teen charged in death of Warner Robins teenager set to appear in court Wednesday, records show ... See MoreSee Less

Teen charged in death of Warner Robins teenager set to appear in court Wednesday, records show

www.13wmaz.com

Houston County records report that two teenagers have been indicted and will be appear in court Wednesday.0 CommentsComment on Facebook

Photos from Macon Regional Crimestoppers's post ... See MoreSee Less

Call Now

0 CommentsComment on Facebook

Deputies searching for two Jones County teens last seen Monday night (Find the link below 👇 in the first comment!) ... See MoreSee Less

0 CommentsComment on Facebook

... See MoreSee Less

0 CommentsComment on Facebook

A reward of $8,000 is being offered by the Houston County District Attorney’s Office through the Macon Regional Crimestoppers, according to a media release.

Link in the comments. ... See MoreSee Less

0 CommentsComment on Facebook

Houston County DA offers $8,000 reward to crack unsolved 1984 homicide case ... See MoreSee Less

Houston County DA offers $8,000 reward to crack unsolved 1984 homicide case

wgxa.tv

Houston County District Attorney's office is giving an $8,000 reward for help in solving an unsolved homicide from 1984.0 CommentsComment on Facebook

Perry woman sentenced to 12 years for trafficking meth in Houston County, DA says ... See MoreSee Less

Perry woman sentenced to 12 years for trafficking meth in Houston County, DA says

wgxa.tv

A Perry woman will spend 12 years in prison after pleading guilty to selling illegal narcotics in Houston County, according to the district attorney's office.H0 CommentsComment on Facebook

🚨 ÚLTIMA HORA: Fuerte despliegue policial en Red Fox, Warner Robins.

¿Vives en la zona de Red Fox? Vecinos reportan una intensa movilización de patrullas y hasta un helicóptero sobrevolando el área desde hace 40 minutos. De manera EXTRAOFICIAL nos informan que al parecer la policía busca activamente a un individuo y la situación sigue en desarrollo.

⚠️ RECOMENDACIÓN: Manténgase dentro de su hogar y asegure sus puertas mientras las autoridades aseguran el perímetro.

📹 Cortesía

@fansdestacados ... See MoreSee Less

🚨 ÚLTIMA HORA: Fuerte despliegue policial en Red Fox, Warner Robins. ¿Vives en la zona de Red Fox? Vecinos reportan una intensa movilización de patrullas y hasta un helicóptero sobrevolando el área desde hace 40 minutos. De manera EXTRAOFICIAL nos informan que al parecer la policía busca activamente a un individuo y la situación sigue en desarrollo. ⚠️ RECOMENDACIÓN: Manténgase dentro de su hogar y asegure sus puertas mientras las autoridades aseguran el perímetro. 📹 Cortesía @fansdestacados

www.facebook.com

0 CommentsComment on Facebook

Common sense …Police: Montezuma man in custody after threatening officer with knife during arrest attempt (Find the link below 👇 in the first comment!) ... See MoreSee Less

0 CommentsComment on Facebook